Budget Review

First off, congratulations to each and every person that voted for Issue 2 or supports cannabis legalization in the Grate State of Ohio. We are headed into a legislative recess with no substantial changes made to ORC 3780 via SB56 and HB160. Even the changes made by HB96, aka our state’s budget bill, were not detrimental to our program. For those of you that spoke up, spoke out, and stood firm in their convictions, take a moment and be proud of your work. In a time of loss, confusion and fear nationwide, you stood up for something that mattered. Your voice was heard. You made a difference.

In the coming week or two, I will be posting details about how to get more involved this summer with advocacy, activism and legislation as we create framework for our cannabis policy. EbTHC’s official plan is to create a large framework of what a proper cannabis program looks like in this state, and then submitting smaller, issue specific bills to the Legislative Services Committee with a Sponsor so they can be introduced as legislation and heard by Committees.

Before we get to that, let’s review the Budget that was signed by Governor DeWine this morning.

Below is a breakdown of some of the most notable changes made to the cannabis program found in the budget. This is not an exhaustive list, but I did find Cannabis mentioned 122 times and these were the ones I felt needed to be called out. The 3167 page budget can be found here. In addition, Governor DeWine’s Veto list and reasoning can be found here.

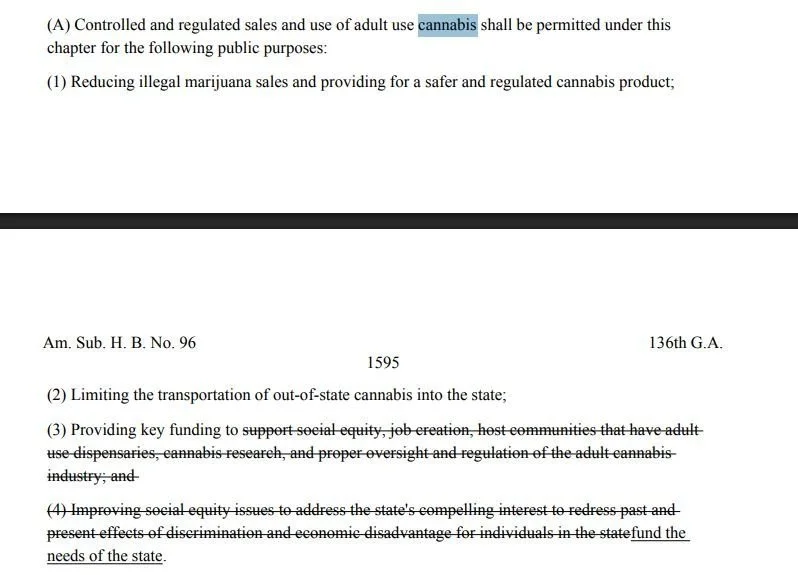

Pg. 1595

Removal of social Equity program and made the language “Providing key funding to fund the needs of the state.”

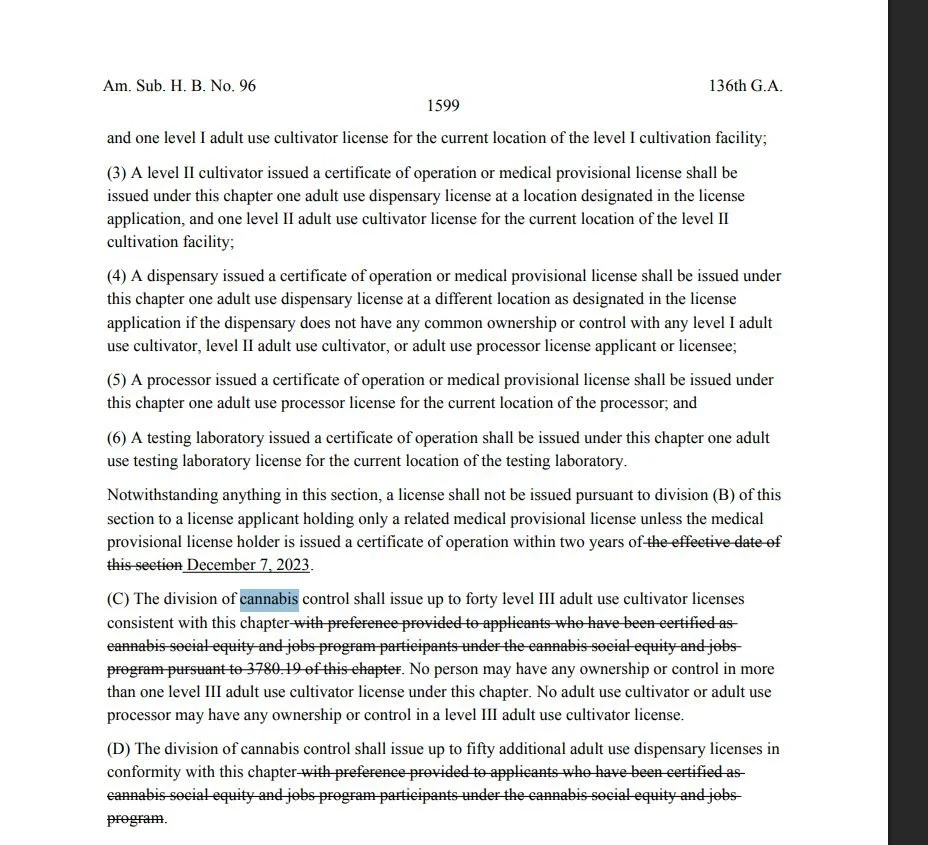

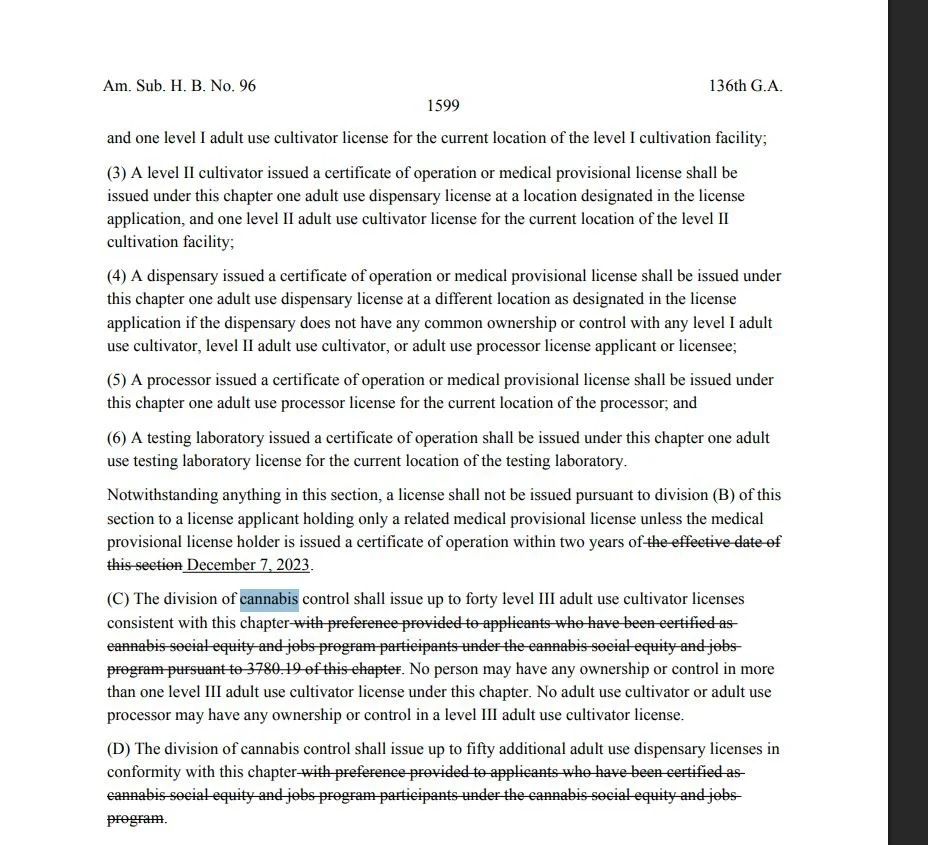

Pg. 1599

The new budget DOES allow for Level III cultivation sites, but those are no longer being granted with preference to those qualified for the social equity program, as that program will not be created.

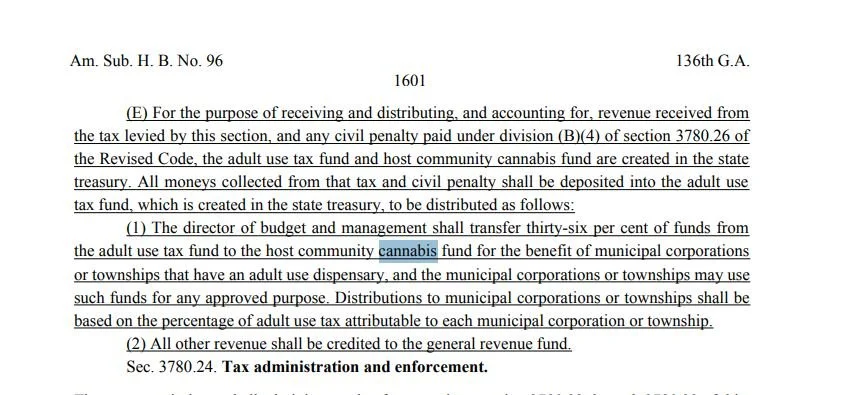

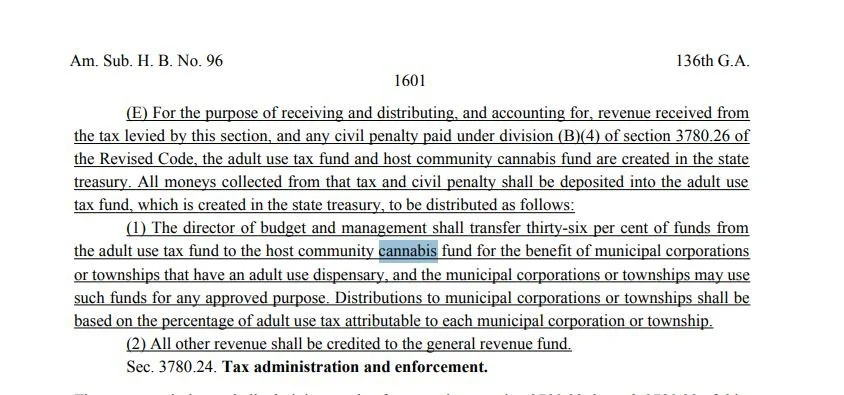

Pg. 1601

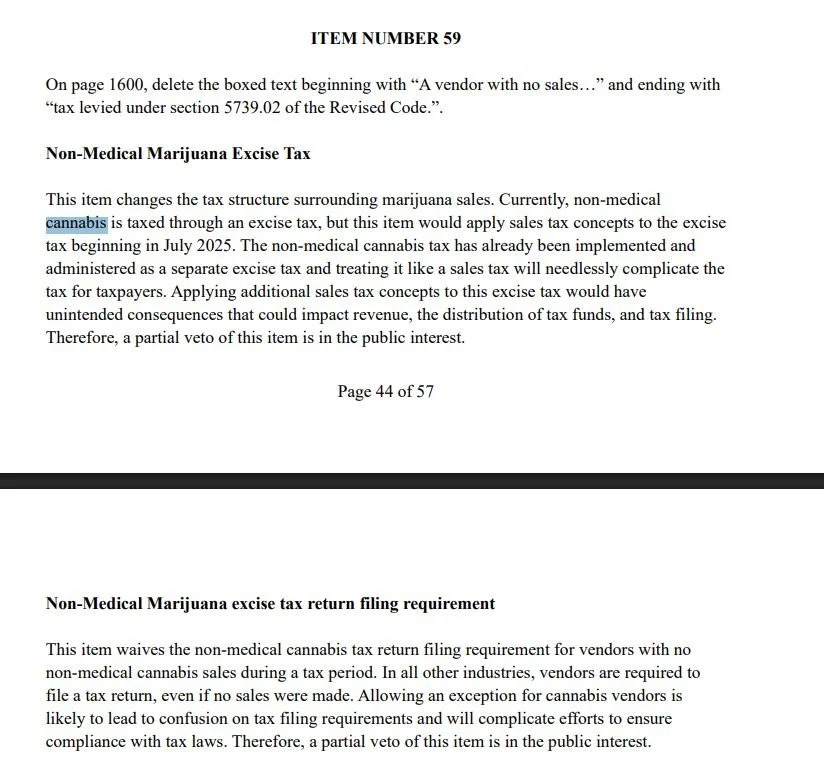

Creating an actionable method for taxes to be dispersed to their municipalities and townships, while also reallocating the rest of the 10% excise tax into the General Revenue Fund.

Breakdown- Of the 10% excise tax applied to Adult-Use cannabis sales, 36% of that tax revenue will go to the Host Community fund and be provided to localities. The remainder (64%) of the excise tax revenue will be sent to the General Revenue Fund for “the needs of the state”

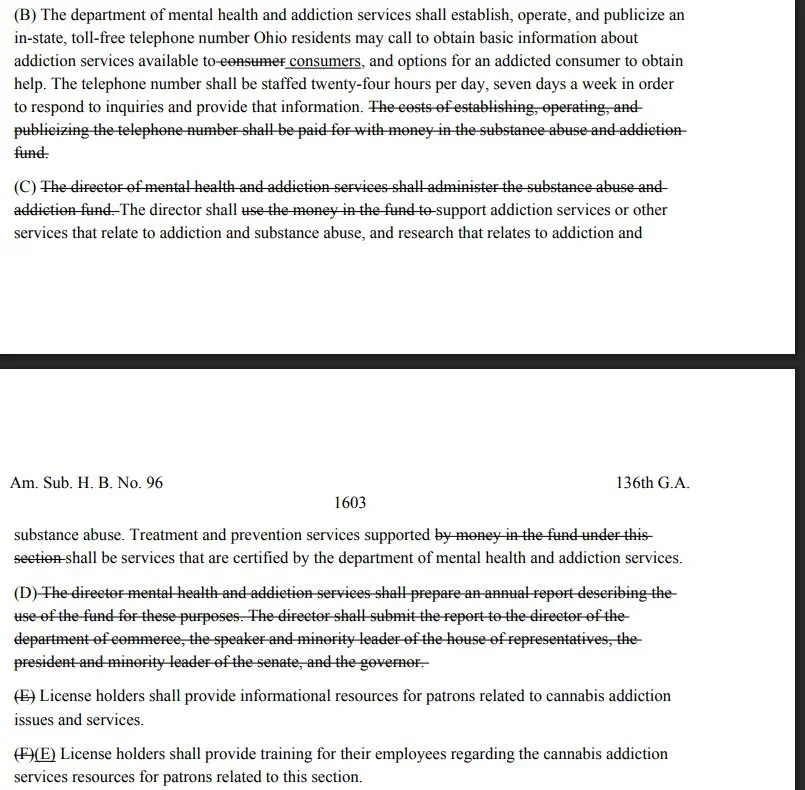

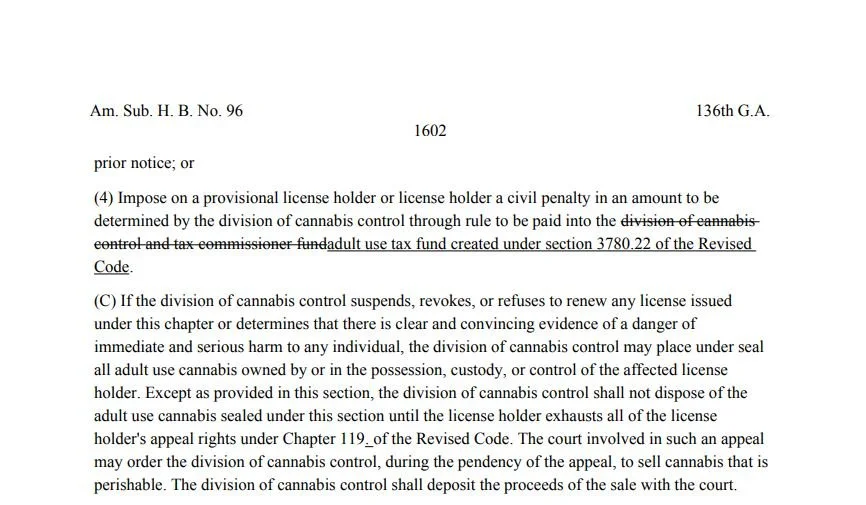

Pg. 1602

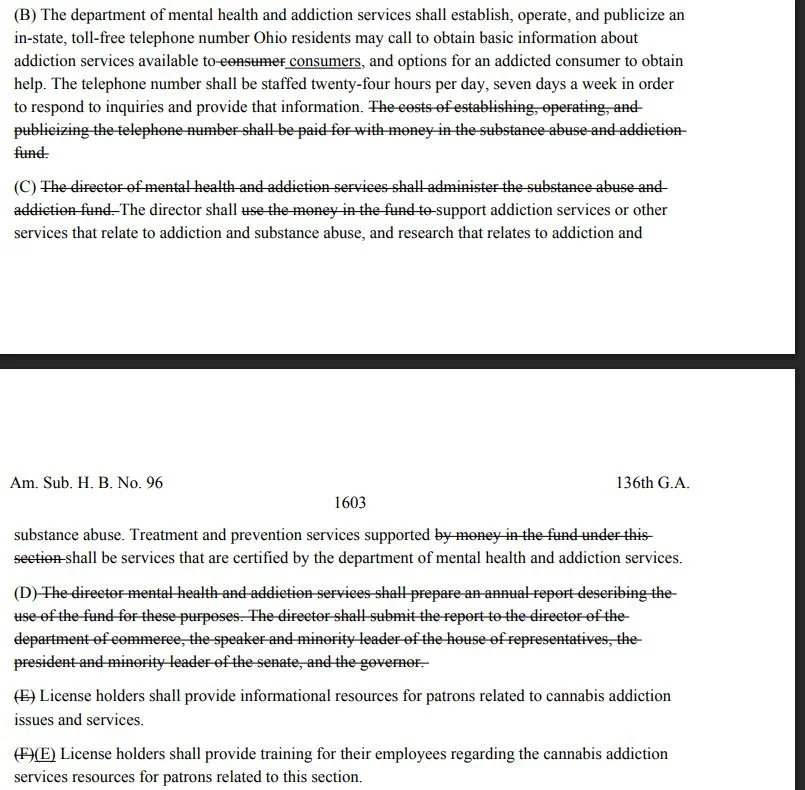

Removing funding for the substance abuse and addiction fund, as all taxes revenue (outside of localities portion mentioned above) is now going to the GRF.

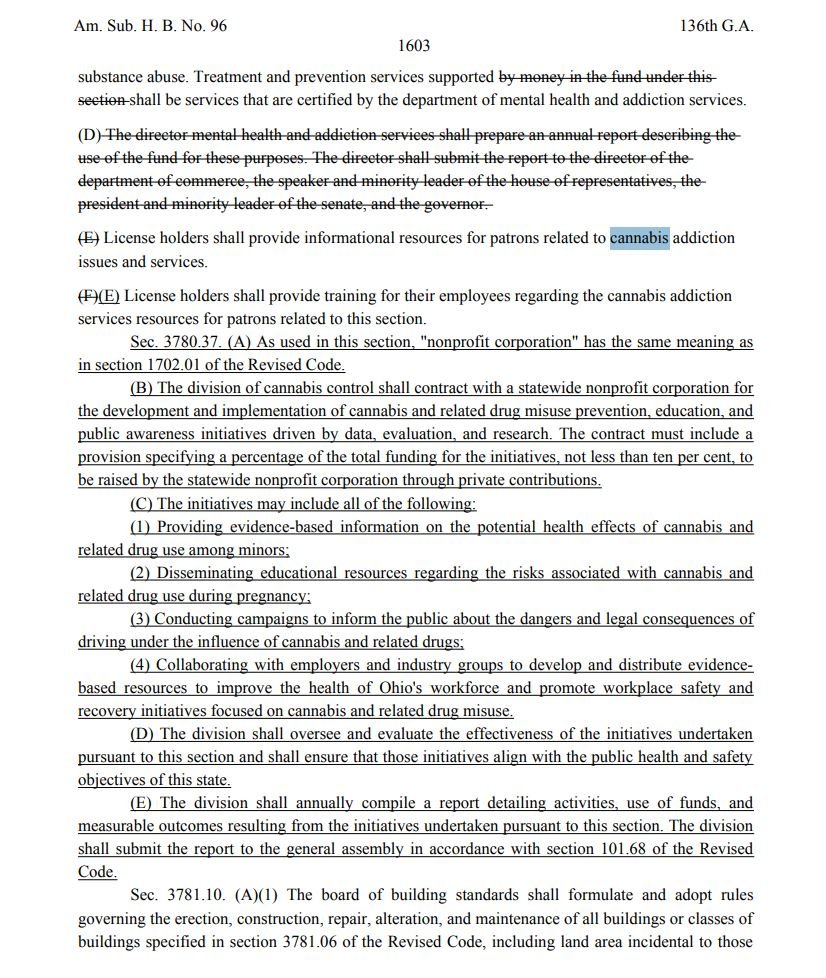

Pg. 1603

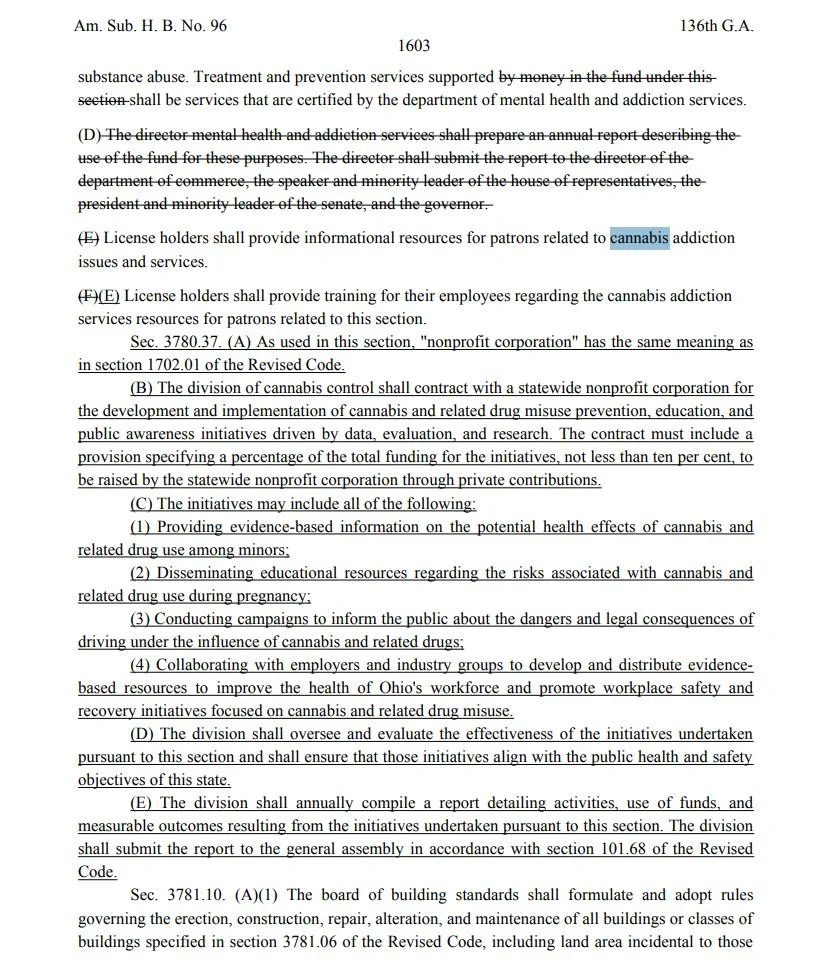

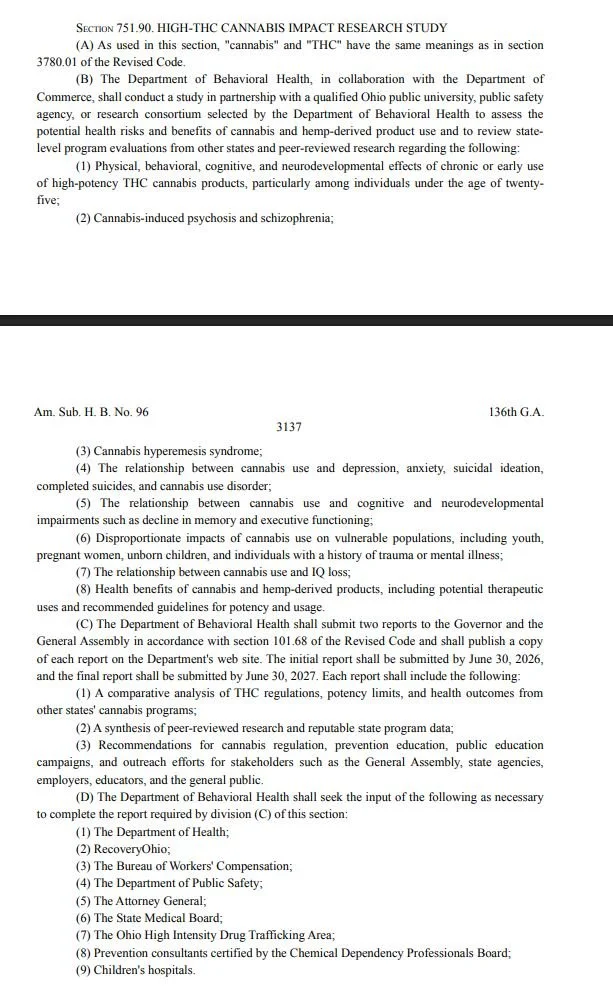

The State plans to hire a non-profit corporation to teach the public about the dangers of cannabis. Not about proper medicinal use, not about the spiritual history, but teaching people what might happen if they “use too much.” This is an example of how cannabis faces scrutiny unlike more harmful drugs like nicotine and caffeine. This includes a study on “High-THC” usage, also funded by cannabis sales.

Below is a full list of screenshots that I found with pages making changes to cannabis policy in Ohio, as well as Gov. DeWine’s veto on the an additional cannabis tax.

If you made it this far, thank you so much for reading and staying involved.

By mid July; I intend to have a process in place for the community to contribute to the legislative framework that EbTHC will be presenting to Legislative Services Committee with Rep Sponsorship. We already have Norml National, the ACLU and other policy makers and lawyers willing to review and contribute, but I want to be clear- this legislation is going to represent the will of Ohio. Specifically, I want members of the Ohio Cannabis Consumer Coalition to have their voices heard and enshrined in the Ohio Revised Code, we deserve it.

P.S. My indoor and outdoor grows are taking off right now. I am working hard across the state helping many people grow. I will be creating ways for people to share their grow progress on this website coming soon as well!

High, and gratefully yours,

Eric “Eb” Whited

P.P.S- tell ‘em Eb did it.